“It is clear that climate action will make life increasingly difficult for businesses that profit from fossil fuels,” writes Jim Krane, an energy fellow at the Baker Institute for Public Policy. “For the industry, a new set of risks has come to the fore.”

Krane’s paper reads both as a warning to the industry, and as a laundry list of threats.

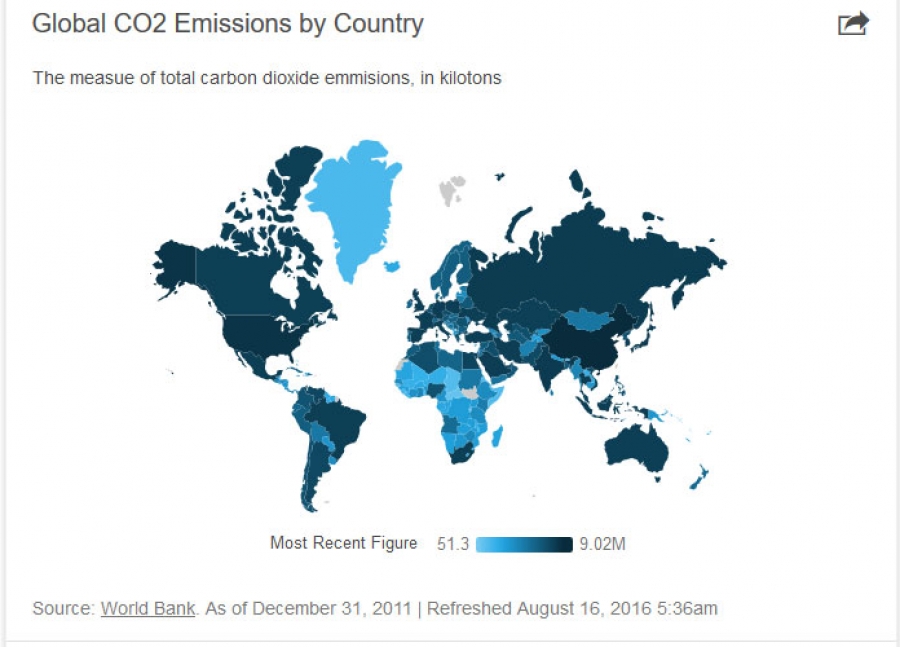

Coal, oil and natural gas are responsible for two-thirds of the world’s emissions of greenhouse gases, Krane reports. World leaders have suggested energy companies might need to leave fuel reserves in the ground instead of releasing more carbon. The multinational banking firm Citicorp estimates that such large-scale resource abandonment could cost $100 trillion in lost revenues by 2050.

Governments around the world are already moving to restrict fossil fuel consumption. The 2015 Conference of Parties climate agreement, signed in Paris, represents “an ominous milestone” for the industry, Krane writes, with “promises to reduce carbon from nearly every country on earth, covering 99 percent of emissions.”

Demand for fossil fuels will peak and begin to decline, the paper continues — global coal consumption may have already. It dropped by 100 million metric tons, or almost 2 percent, in 2015. U.S. coal use plunged 13 percent in 2015. Chinese demand has fallen for two years in a row. Only natural gas will likely benefit, in the near term, from climate change policies, Krane writes, as countries look to shift electric power creation away from coal.

Moreover, he says, some large investors are beginning to avoid fossil fuels. The Norwegian Government Pension Fund, the world’s largest hydrocarbon-based sovereign wealth fund with some $900 billion in assets, divested last year from coal companies. The Rockefeller Brothers Fund, started by the Standard Oil fortune, pledged two years ago to eliminate its exposure to coal and Canadian oil sands.

Finally, Krane writes, climate change could drive fossil fuel companies to out-compete each other. If oil producers think climate regulations might prevent them from pulling out oil reserves, they may step up production. “The curtailment of future oil demand would be disastrous for Saudi Arabia, Venezuela and other large producer states, few of which have diversified economies ready to move beyond oil,” Krane writes.

Instead, the countries could increase production, drive down prices and shift the risk of stranded reserves to areas like U.S. shale plays, which require higher costs to produce oil.

“The industry faces a future that is less accepting of its current practices,” Krane concludes. “Some businesses will not survive. For others, the risks warrant changes in strategic direction.”

http://fuelfix.com/blog/2016/08/12/coal-isnt-the-only-fossil-fuel-in-trouble/