This June, we hosted a webinar dedicated to the role of natural gas in the modern economy and the evolving context of energy transformation and climate policy in Poland and the European Union.

The event gathered experts in energy transition, climate action, and gas policy who shared insights on the current and future role of natural gas, potential alternatives, and systemic challenges.

Speakers included Diana Maciąga, Claudia Ciobanu, Agata Pyka, Michał Zabłocki, and Kuba Gogolewski.

Gas demand projections for Poland: 2030 and 2040

According to data presented by Diana Maciąga, Poland's gas demand is projected to peak around 2030, with volumes of approximately 20–23 billion cubic meters (bcm) depending on the scenario. After this peak, demand is expected to decline to about 13 bcm by 2040. However, this trajectory is not backed by detailed sectoral plans or comprehensive reduction scenarios.

Planned expansion of gas-fired capacity

At the same time, Polish energy companies (Orlen, PGE, ENEA, Veolia) continue to plan significant investments in new gas-fired capacity. Diana Maciąga’s presentation highlighted that currently planned projects include:

- Large CCGT plants (over 7.2 GW combined), such as Orlen Ostrołęka (745 MW), PGE Adamów (585 MW), PGE Rybnik (860 MW), and several ENEA and Veolia projects.

- New CHP (combined heat and power) units totaling approximately 1.5 GW. These investments reflect a strong push towards expanding gas-based generation despite climate goals and emerging alternatives.

Shifting sectoral gas consumption

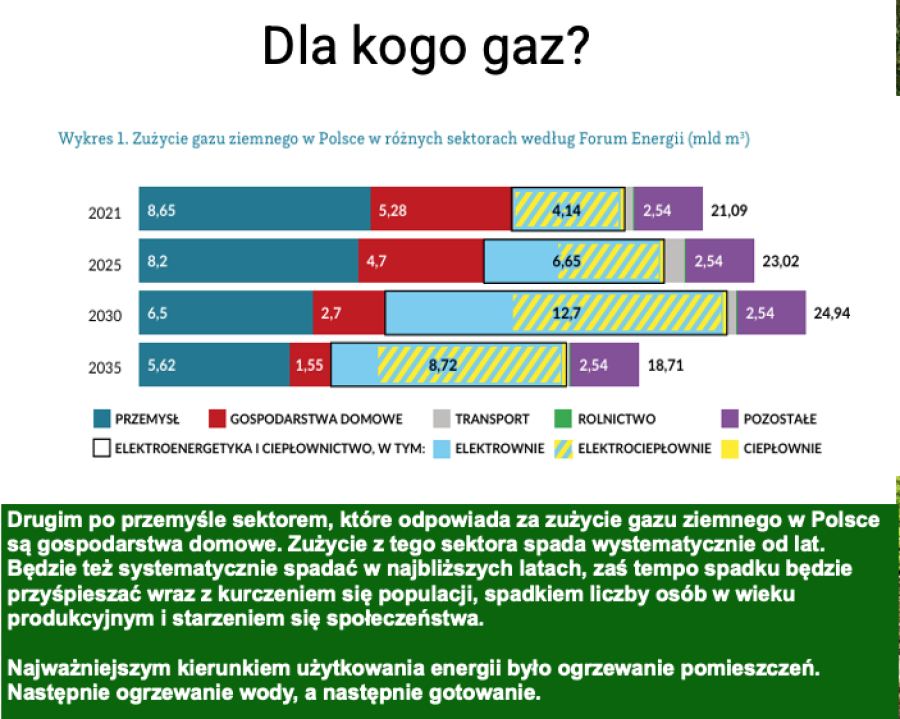

Currently, the industrial sector remains the largest consumer of natural gas in Poland, accounting for around 62.7% of total demand. Key industrial uses include chemical processes, ammonia production, and hydrogen production.

However, this dominance is expected to shift. In the coming years, energy and district heating sectors are projected to play an increasingly prominent role in gas consumption, driven largely by the commissioning of new gas-based CHP plants.

Recent gas demand reduction (2022–2023)

Between April 2022 and March 2023, Poland recorded an approximately 11% reduction in gas consumption compared to the reference period of 2017–2022. This figure aligns with the voluntary EU reduction targets, although Poland formally declined to adopt them.

Lack of reduction scenarios and energy efficiency planning

Despite these developments, Diana Maciąga emphasized that Poland lacks detailed scenarios for reducing gas consumption over the coming years and decades. There is also a lack of integrated strategies aimed at effectively reducing electricity consumption or curbing its growth — a crucial gap given that increasing electricity demand is driving the perceived need for more gas-fired power and CHP capacity.

The role of state-controlled companies

Corporate strategies of state-controlled giants (Orlen, PGE, ENEA, Tauron) reflect a growing reliance on natural gas. These companies plan substantial new gas investments and project increasing gas consumption within their portfolios.

Moreover, these firms are also major contributors to public revenue through taxation:

- Orlen paid PLN 364 billion in taxes (2008–2022).

- Lotos contributed PLN 192 billion.

- PGNiG paid nearly PLN 67 billion.

Budget constraints and political realities

Given growing public expenditure pressures (notably for defense), it is politically unlikely that the government would risk significant declines in budget revenues from these state-controlled companies. Deep reductions in national gas consumption would inevitably impact these revenues.

Therefore, it is crucial to redirect attention toward large privately-owned companies, particularly those controlled by the wealthiest individuals. These firms are substantial consumers of both gas and electricity and possess the financial means to undertake transformative investments.

The need for an integrated cross-sector strategy

All speakers agreed that Poland urgently needs a comprehensive, cross-sector strategy to phase out natural gas. This strategy should encompass:

- Industry — huge energy-intensive sectors.

- Energy and district heating — with a clear limitation on new gas-based investment plans.

- Households — through energy efficiency improvements and the electrification of heating.

- Transport — where gas should not be promoted as an alternative fuel.

Why It matters

Reducing gas consumption is not just about addressing climate change. It is also about:

- Enhancing energy security — reducing import dependence.

- Lowering living costs — avoiding future price crises.

- Increasing Poland’s economic competitiveness.

- Improving public health and environmental quality.

The "Natural Gas under scrutiny" webinar demonstrated that while Poland faces significant challenges, it also has tangible opportunities and technological pathways to reduce the role of natural gas. The key will be to move beyond the outdated narrative of gas as a “transition fuel” and to embrace a forward-looking strategy centered on renewables, efficiency, and electrification.