5th of July 2021

Dear Sir/Madam,

As you are aware, in its recently published Net Zero by 2050 Scenario (NZE 2050), the International Energy Agency (IEA) concluded that “there is no need for investment in new fossil fuel supply”, in a welcome reversal of long-held positions. Considering that your institution is committed to a net-zero target, we would like to take this opportunity to highlight important considerations for those possessing and advocating for a credible net-zero strategy.

Founded by OECD countries in response to the oil crisis of the 1970s, the IEA has long boosted the development of fossil fuels and minimized the potential of renewable energy technologies. This new IEA conclusion is a massive shift from its past positioning. It confirms that governments, investors, banks and insurance companies no longer have any justification for supporting new oil, gas or coal projects.

The new IEA report finds that reducing global carbon emissions to net-zero by 2050 calls for “nothing less than a complete transformation of how we produce, transport and consume energy” (p. 13). This transformation requires a massive effort to scale up public and private investments in energy efficiency and renewable energy infrastructure. It requires even faster action in OECD and European countries, that are responsible for 2⁄3 of the mitigation actions recommended by the IEA by 2030 (see Figure 2.2, p. 53) and should achieve the carbon neutrality of their power sector sooner. But, in return,

it will create 25 million new jobs globally (p. 159) and result in at least two million fewer premature deaths per year from air pollution (p. 169).

Of course, the IEA scenario is far from perfect. It falls short of providing a truly sustainable pathway by underestimating the potential of wind and solar, wrongly betting on biomass, large hydro, blue hydrogen, and nuclear (all of which would face huge public opposition and grassroots resistance), and overestimating the likely potential of unproven carbon capture and storage (CCS) technologies. The huge expansion of bioenergy supply is particularly concerning because of its potential impact on biodiversity and land rights, and because it would likely only increase GHG emissions. As the European Academy of Sciences Advisory Committee (EASAC) said in an open letter “when a power station switches from coal to wood pellets, a significant amount of extra CO2 is released, so there follows a period (carbon payback period) during which switching from coal to forest biomass increases atmospheric levels of CO2. This is often a long period – much beyond the time we have available to meet Paris Agreement targets of limiting warming to 1.5-2°C.”

Although the IEA’s unrealistic assumption of a massive deployment of CCS allows for fossil fuel production to diminish more slowly than in both the UN Production Gap Report and the IPCC’s Special Report on 1.5°C Pathway 1, the IEA still finds that “net-zero means a huge decline in the use of fossil fuels” (p. 18). According to its roadmap, the demand for coal, oil and gas will fall by 90%, 75% and 55% by 2050 respectively, compared with 2020 levels. The IEA concluded that: “Beyond projects already committed as of 2021, there are no new oil and gas fields approved for development in our pathway, and no new coal mines or mine extensions are required” (p.21).

The IEA shows clearly that the reduction in the extraction and consumption of coal, oil and gas needs to start today. Contrary to what many gas companies are arguing, the IEA also states that “many of the liquefied natural gas (LNG) liquefaction facilities currently under construction or at the planning stage” are not needed. The IEA shows that less than 13% of current gas consumption in the electricity and heat sectors would be needed for these uses by 2040 (see Table A.1, p. 195).

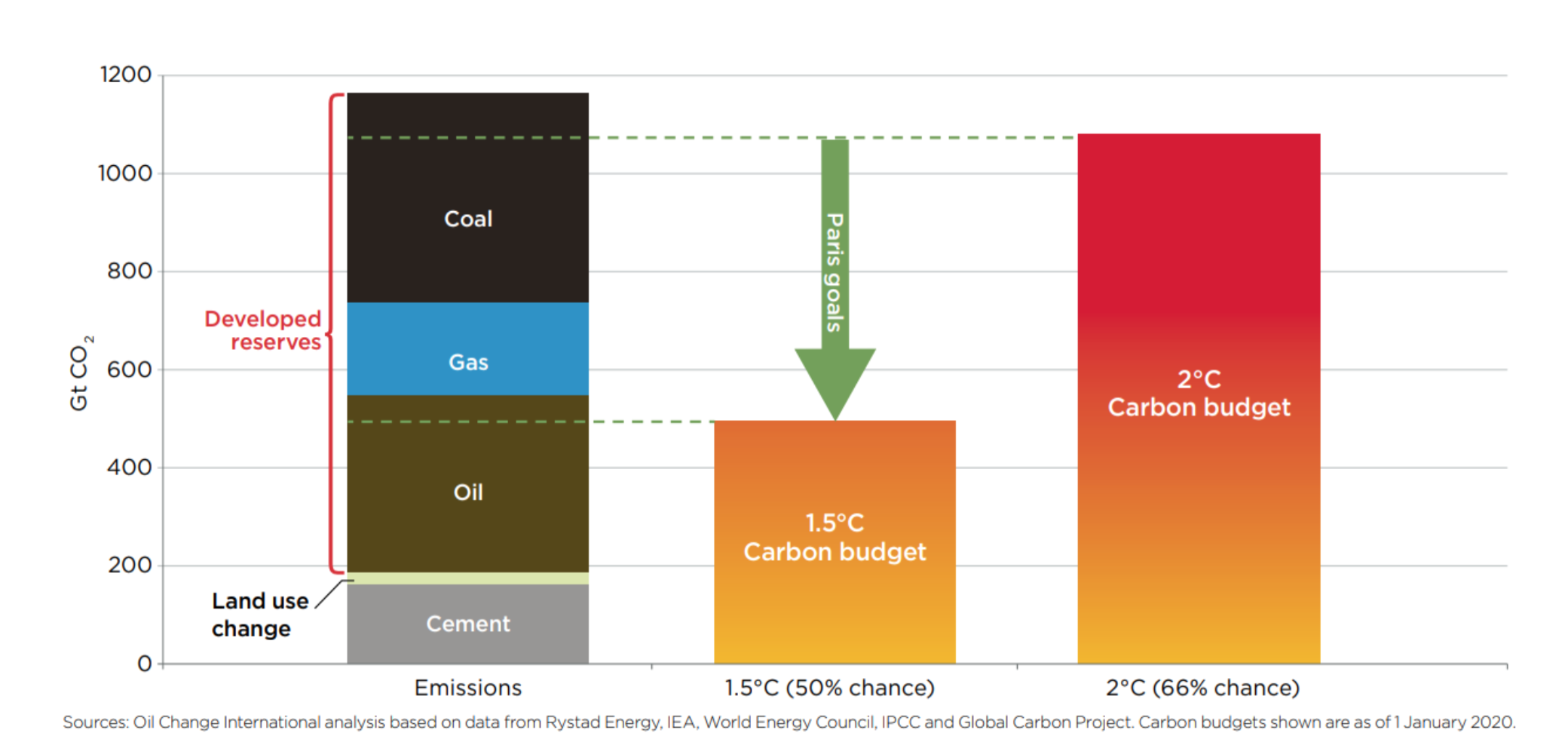

CO2 emissions from developed global fossil fuel reserves, compared to carbon budgets within range of the Paris goals, analysis by Oil Change International.

The science has been clear on the need to immediately and drastically reduce fossil fuel production for a long time. Existing coal, oil and gas projects will already take us well beyond a 1.5°C target. In that context, the IEA scenario lays out the minimum requirement for starting to align with a 1.5°C trajectory but is not sufficient to do so.

The Net-Zero Asset Owner Alliance, Net-Zero Asset Managers Initiative, and Net-Zero Banking Alliance require their members to use “science-based guidelines” to reach net-zero emissions by 2050 at the latest, and to keep warming below 1.5°C. If these claims of being committed to both net-zero by 2050 and 1.5°C are to be credible, the members of these initiatives must take the following immediate actions:

-

In line with the IEA scenario, publicly acknowledge that a pathway to 1.5°C means an immediate end to investments in expanding supply of fossil fuels and rapidly winding down their production, and agree to update policies to align with this before COP26 this November.

-

Immediately cease financial support for all new, and expanded, coal, oil and gas projects. New or expanded coal, oil, and gas projects are defined as those that result in an increase in developed reserves or production, or infrastructure projects that drive expanded extraction or lock us in to fossil fuel-based energy production.

-

Immediately cease financial support to companies that are planning new coal, oil and gas production, transport, transformation, or power projects.

-

Immediately cease financial services to coal companies, unless they have an asset-based coal exit plan to close, rather than sell or convert to biomass or gas, all coal-related assets by 2030 in EU/OECD countries and by 2040 globally. Coal companies are defined as those that generate.

at least 20% of their revenue from mining and transporting coal or at least 20% of their electricity from burning coal; or produce at least 10 million tonnes of coal per year, or operate at least 5GW of coal-fired power stations. Engage with other companies operating in the coal sector to adopt an asset-based coal exit plan to close, rather than sell or convert to biomass or gas, all coal-related assets by 2030 in EU/OECD countries and by 2040 globally and commit to suspend all new financial services to companies that will fail to deliver on this demand by the end of 2021.

-

Phase out financial services to oil and gas companies that do not have credible phase-out trajectories in line with a 1.5°C pathway trajectory and stop financial support to all companies that refuse to do so. To be consistent with a 1.5°C pathway, oil, and gas production would have to decline annually by 4%, and 3%, respectively. Any company that is building new oil or gas expansion projects is failing to align and the financial institution should therefore cease financial support to it.

-

Engage with the IEA to demand the NZE 2050 becomes its reference scenario and is reviewed to provide a sustainable path to limit global warming to 1.5°C. Specifically, ask for its inclusion as the central scenario in the 2021 and subsequent editions of the World Energy Outlook; its alignment with IPCC recommendations to halve greenhouse gas emissions by 2030; and the adoption of a precautionary approach on the use of negative emission technologies and bioenergy.

Based on the IEA’s clear guidance and our demands above, we would like to know more about your plans and strategies to reach net-zero. As part of our activities, we are closely following the progress and policy developments of financial institutions, and will therefore be happy to engage with you and your staff on this topic and to answer any questions you may have.

Yours sincerely,

Amazon Watch

Moira Birss, Climate and Finance Director

Bank on our Future

Becky Jarvis, Senior Strategist

BankTrack

Johan Frijns, Director

Fossil Free California

Sandy Emerson, Board President

Fundacja “Rozwój TAK – Odkrywki NIE”

Kuba Gogolewski, Senior Finance Campaigner

Oil Change International

Kyle Gracey, Research Analyst

Public Citizen

David Arkush, Director, Climate Program

Rainforest Action Network

Jason Opeña Disterhoft, Climate and Energy Senior Campaigner

Re-set: platform for socio-ecological transformation

Josef Patočka, Campaigner

Reclaim Finance

Lucie Pinson, Executive Director

ReCommon

Simone Ogno, Finance and Climate Campaigner

Solutions for Our Climate

Sejong Youn, Director, Climate Finance Program

Stand.earth

Richard Brooks, Climate Finance Director

SumOfUs

Leyla Larbi, Senior Campaigner

Urgewald

Katrin Ganswindt, Campaigner

350.org

Yossi Cadan, Global Finance Campaign Manager